Best Describes Gross Profit in the Context of Accounting

It is the reward for taking a risk and investing money to start and run a business. Cloud computing involves long-term contractsb.

Cost And Management Accounting

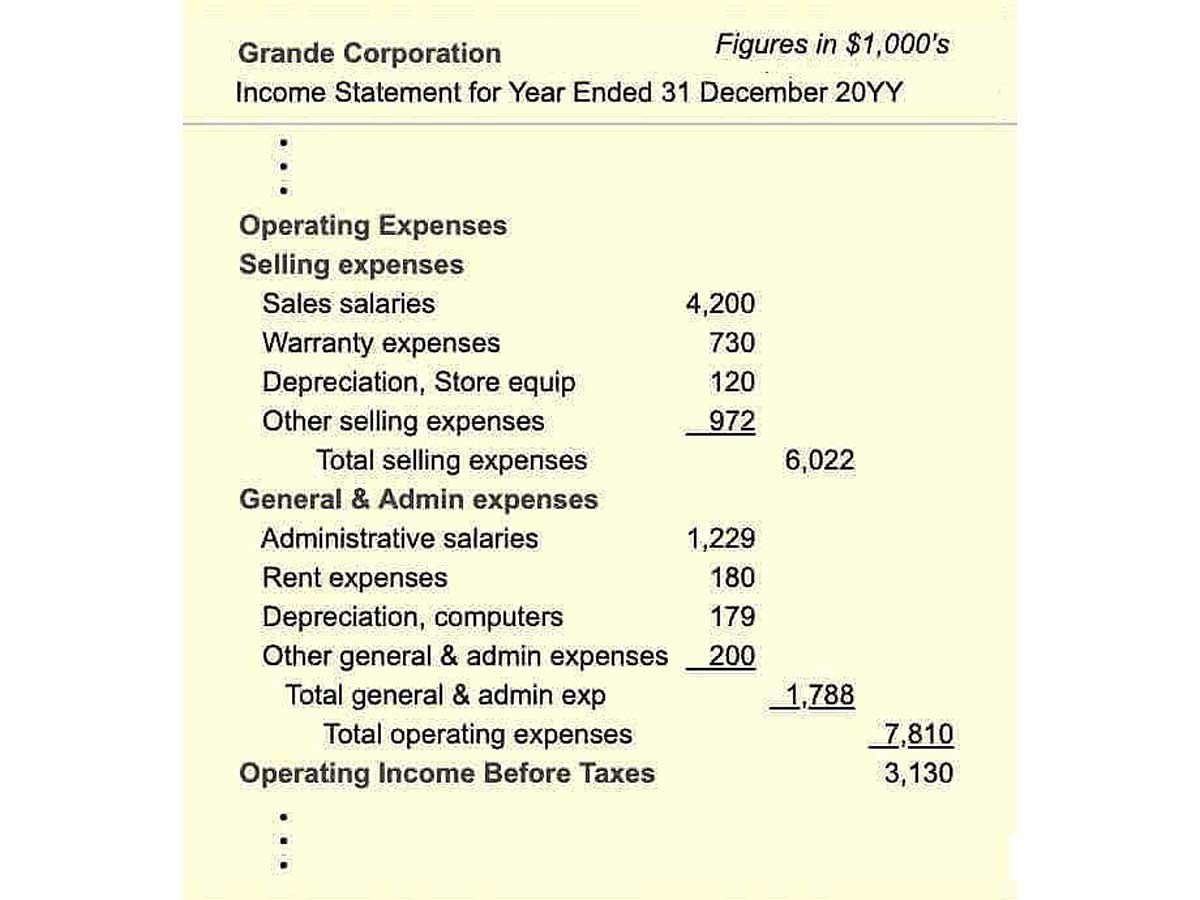

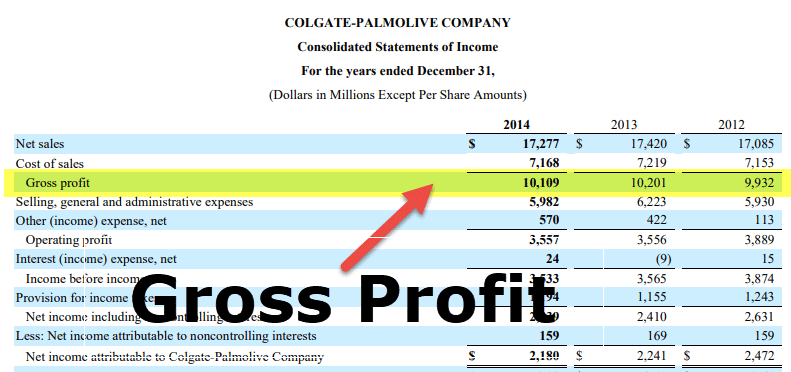

However gross margin can also mean the gross profit expressed as a percentage of net sales Gross profit is presented on a multiple-step income statement prior to deducting selling general and administrative expenses and.

. Debt to equity ratio. The Gross Profit GP of a business is the accounting result obtained after deducting the cost of goods sold and sales returnsallowances from total sales revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. It excludes indirect expenses like distribution costs marketing and accounting.

Which of the following phrases best describes comparability as it relates to accounting information. Therefore the accrual basis of accounting provides a more accurate measure of a companys profitability. Gross profit is an economics term that describes the amount of money a company makes from the sales of goods or services minus the cost to produce or deliver them.

Gross profit Net sales minus the cost of goods sold where Net sales Gross sales minus returns allowances and discounts. In accounting the terms sales and. 1 what revenues were earned and 2 what expenses were incurred.

Gross profit is the amount remaining after deducting the cost of goods sold COGS or direct costs of earning revenue from revenue. Cloud computing is location-independentcomputingc. Higher price would mean higher sales and consequently higher gross profit.

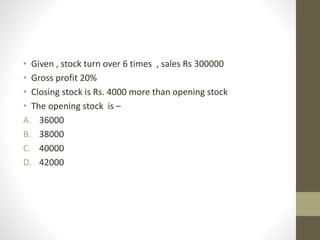

Calculate the following profitability ratios for 2020. What is Gross Profit. What Causes Changes in Gross Profit.

Gross profit is the profit a company makes after deducting the costs of making and selling its products or the costs of providing its services. Government Accounting Vs. Profit is the difference between revenue and expenses not cash received and paid.

It represents the con sidered opinion of the Committee on Franchise Accounting and Auditing and as such contains the best thought of the profession as. Gross profit is sometimes referred to as gross margin. Business Accounting QA Library The amount and trend in gross profit is closely monitered by management in assessing the profitability of a firm.

Which statement below best describes how the bookkeeper would record this. The unit volume of items sold have changed. The formula used in calculating the vertical analysis is.

Business Accounting QA Library Which statement best describes cloud computinga. Times interest earned ratio. It reveals the amount that a business earns from the sale of its goods and services before the application of selling and administrative expenses.

Gross Profit. Gross profit is net sales minus cost of goods sold COGS which is the direct cost of producing the items sold. Gross profit is the total revenue less only those expenses directly related to the production of goods for sale called the cost of goods sold COGS.

Note that the cost of goods sold is a measure of the direct costs required to produce a good or service like materials and labor. Gross Profit Sales minus Total Direct Overhead Costs Cost of Goods Sold Net Profit Gross Profit minus all other operating and indirect costsNet Profit is also called Net Earnings Net Income Actual Profit etc. Cloud computing involves an organizationselling its IT resources to a vendor and leasingback IT services from the vendord.

Expenses are matched to revenues for example if rent has been set as a percentage of sales a turnover rent then the rent is accrued in the accounts is the same period as the sales and not when the rent is actually paid. Increase Decrease 2019 2018 Amount Percentage Net income 54000 22000 32000 14545 3. First statement best describes differences in gross and net profit margin that we observe.

In other words under the accrual basis of accounting the receipt of cash and the payment of cash are not the focus of reporting revenues and expenses. When products are unique or has a unique feature that no other product has companies who manufacture them can charge them for a higher price and people would still buy them. Profit is the remaining amount of a companys revenue after all costs have been deducted.

Gross profit is typically stated partway down the income statement prior to a listing of selling general and administrative expenses. The objectives and operations of a government and a profit business are entirely different from each other. More What Is Operating Income.

Gross profit is defined as net sales minus the cost of goods sold. Rather the focus is. Which of the following describes the information reported in the income statement.

Gross profit sales revenues cost of goods sold. Which accounting concept does the comment below refer to. Gross profit is calculated as.

The costs of items sold vary by industry but they generally follow the. This AICPA industry accounting guide is published for the guid ance of members of the Institute in examining and reporting on financial statements of franchise companies. Vertical analysis Specific item Base amount 100 A True B False 1.

True or False True or False The amount and trend in gross profit is closely monitered by management in assessing the. Sales prices have changed. Calculating profit as a percentage of revenue makes it easier to analyze profitability trends over time and to compare profitability with other companies.

Gross profit Revenue minus cost of products sold equals gross profit. However there are different categories of profits. Gross profit Sales - direct materials - direct labor - manufacturing overhead.

In the context of the Standards of Ethical Behavior for Practitioners of Management Accounting and. The mix of products sold has changed which alters the gross profit if different. When it comes to accounting governments are more concerned with budgets while business enterprises give priority to return on investment in terms of.

GAAP in an accounting context stands for. A change in gross profit can be caused by any of the following events. Gross profit is net sales minus the cost of goods sold.

GP is located on the. Net income for the period calculated as revenues minus expenses d. The gross profit for Shelby Ltd for September 2011 is.

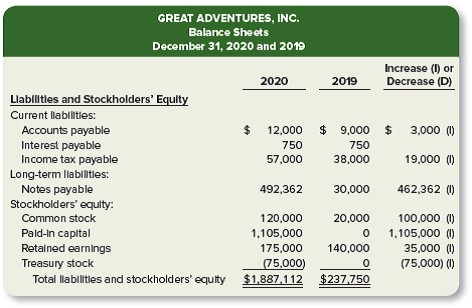

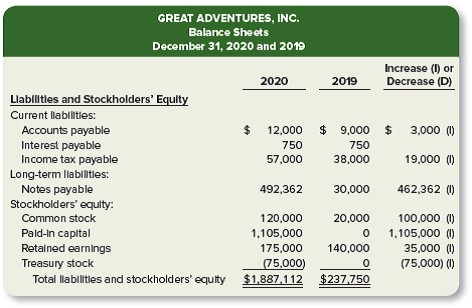

Net cash flows from operating investing and financing activities b Changes in Stockholders equity through changes in common stock and retained earnings c. Gross profit ratio on the MU watches. The formula for calculating gross profit margin is.

As you can see gross profit depicts the difference between net sales and the cost of goods sold.

What Is Gross Profit Gross Profit Formula Definition And More

Sustainability Free Full Text Big Data Big Data Analytics Capability And Sustainable Innovation Performance Html

The Income Statement Income Statement Bookkeeping Business Accounting

Difference Between Gross Profit And Net Profit Difference Between

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

What Does Gross Margin Mean Formula For Calculating

Difference Between Gross Profit And Net Profit Difference Between

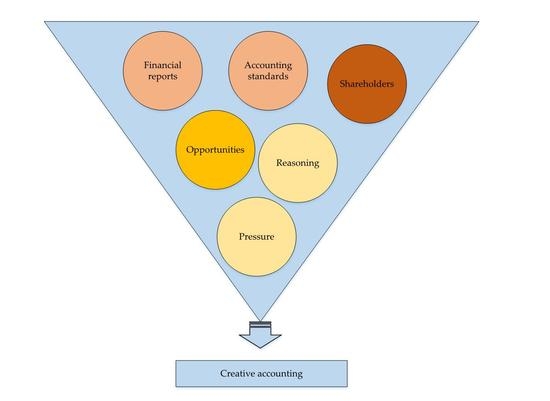

Jrfm Free Full Text Creative Accounting As An Apparatus For Reporting Profits In Agribusiness Html

Chapter 12 Solutions Financial Accounting 4th Edition Chegg Com

Overhead Expense Role In Cost Accounting And Business Strategy

Difference Between Gross Profit And Net Profit Difference Between

Types Of Financial Analysis List Of Top 10 Financial Analysis

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

Common Size Income Statement Definition

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Gross Profit Operating Profit And Net Income

Overhead Expense Role In Cost Accounting And Business Strategy

:max_bytes(150000):strip_icc()/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-02-11524662bf6442b38caada8e903a790a.jpg)

Gross Profit Operating Profit And Net Income

:max_bytes(150000):strip_icc()/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Comments

Post a Comment